#MoneyMovesMonday- High-Yield Savings Accounts

So last week we talked about the importance of managing your time, and its relationship to your wallet. Hopefully, you were able to re-invested some of your time, and use the worksheets I provided to make some SMART financial goals.

So for this week I wanted to continue on our quest of learning more about investing by talking about the importance of how to make your money work for you-- with the best part being that you don't have to do any work to get it!

If many of you grew up like me, I'm sure you were taught that the only way to make money was to work for it.

But as I've gotten older, and gotten much more into being financially educated, it was only a matter of time before I stumbled into learning about the world of investing.

So to invest in a traditional sense is defined by Investopedia as "the act of committing money or capital to an endeavor (a business, project, real estate, etc.), with the expectation of obtaining an additional income or profit."

So in simpler terms it's when you put money into something or someone with the end goal being that you will get your money back with extra. Depending on the level of trust, or the project, some people choose to either be active or passive about their investments. But I would say, for me, the most ideal investment situation is to get to a place where your investment requires little to no involvement/action from you. That's really when you'll be having your money work for you!

So today we'll be exploring a super low-risk, baby step into the world of investing...

So if you have a bank account, you technically already have experience with investing.

How banks work is that you deposit your money into them, and they, in turn, lend your money out to other people with an interest rate attached. It is from this interest rate that they make a profit, and because they wouldn't have money to lend without your generous deposit, they cut you a piece of the interest pie as well.

But one of the biggest problems we've seen with the more popular brick-and-mortar banks is that the return on investment that they are offering depositors lately has been literal pennies every bank cycle (even for someone as myself who used to make a middle class salary).

Some of this has to do with the federal interest rate being as low as it has been over the past couple of years (although it's slowly starting to tick upward, which is great news for lenders, and bad news for new borrowers). But even so, when you bank with a brick-and-mortar bank, part of that return that you should be getting is going towards helping them pay rent for a physical bank.

Some people don't know this, and as the future entreprenuer-boss-queens-in-training that you are, I wanted to share this info with you so that you have the clarity to decide where is going to be the best investment for you and your money.

I decided to open a high-yield savings account after I started seeing a financial planner last year, and, for me, it was one of the best decisions I made.

Now let's be clear-- I'm not making Jay Z type money on this savings account...

But I, at least, make many dollars more than the pennies I was pulling in every year at Bank Of America.

In the words of Kim Kiyosaki, she would call this a "wimpy" form of investing. However, everyone needs their first step, and it it's something that never hurts to have because you'll only be making more money off of it. The reason why Kim calls it wimpy is because of the level of risk involved (low risk=low return). Again, this isn't a bad thing, but it just means you're not making as much as you could be with other forms of investing.

So here are the two banks I use, and why I love them!

1. Synchrony Bank

So I'm not sure if there is a huge difference between them since they have the same logo, but I want to clarify that I use Synchrony BANK, and NOT Synchrony Financial. You might come across both in your search, but I also hyperlinked the right one above.

I have been with them for around a year now, and in that year, their rates just keep getting better and better. I currently make 1.55% back in interest for every dollar in the account (which WAY better than most brick-and-mortar banks despite being terribly low). However, they have CDs (which I can explain in a future post for those who don't know) for as high at 2.50%-- one of the best rates I've seen on the market.

I currently keep my emergency fund there, and after I left BuzzFeed, I stopped putting money into it, but thankfully haven't had to take money out of it yet (good looks, universe)! Because of that, I currently make $10 every month compared to the 10 CENTS I made at BofA in a year when I kept all my money there.

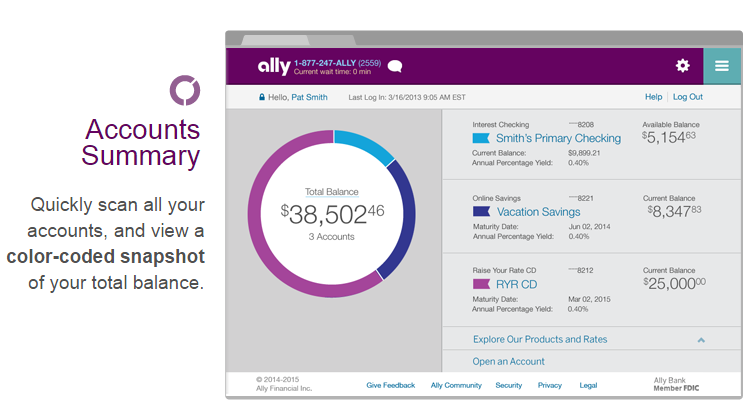

2. Ally Bank

I opened my account with Ally last year, both at the suggestion of my financial planner, and after hearing it mentioned on a financial podcast I was listening to. Ally is commonly hailed as the go-to bank for millennials, and they are completely online. Now I know some people might feel a type of way about online banks, but as long as the bank is FDIC insured, you're good, fam.

So I opened my Ally account largely because of the flexibility in opening accounts. You can open and name as many accounts as you want, which is great for me because I like to have separate accounts for separate goals. So I currently keep my account for what I saved for Yes Queen stuff, my presents and gifts fund, and my weekly flex spending money account over at Ally. (The following is NOT MY MONEY...but don't I wish it was).

One of the money management strategies that I learned with my financial planner is how important it is to have clear boundaries for the purpose of your money. Keeping all of your money in one giant lump sum account can be risky only because we might overspend on the things we want, and not have enough money for the things we need. Part of how you establish those boundaries is by having separate accounts for at least an emergency savings and general checking, with clear cut rules as to what would cause you to dip into those funds.

So you don't have to have your accounts spread out across multiple banks as I do, but many of the financial education resources that I have used recommend having a different bank for at least your emergency savings, so that you don't feel as tempted to dip into it for unwarranted purchases.

Over the past year of banking at Ally, I have also seen the rates just get better and better. I don't make as much money at Ally (because I foolishly opened a money market account rather than a high-yield savings account), but I probably make around a few dollars every month. But I definitely think you'll make around what I'm making at Synchrony with their high-yields savings account.